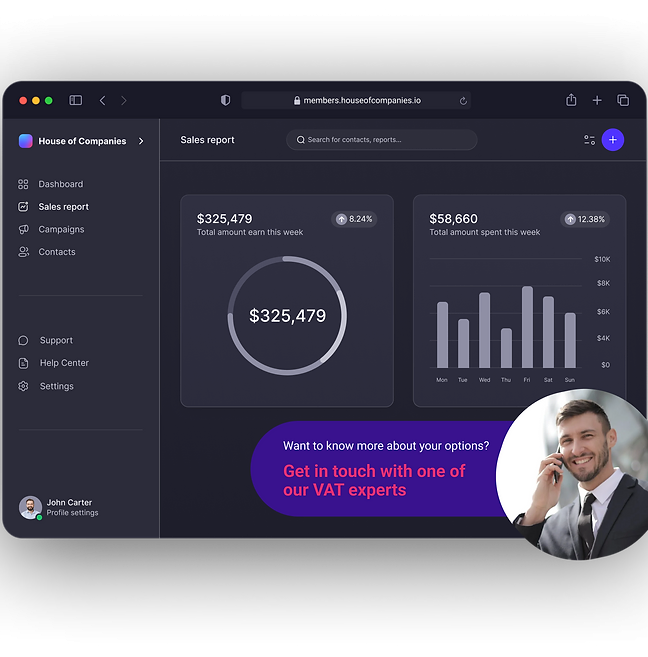

At House of Companies, we are excited to offer top-tier bookkeeping services to our clients in Cyprus. Our team of experts utilizes the latest tools and technologies to deliver innovative and customized solutions that cater to your unique bookkeeping needs. With our advanced support, you can trust that your bookkeeping is in excellent hands.

Cyprus has streamlined its approach to managing financial data such as invoices, bank statements, and agreements (including leases). Our system simplifies the process of submitting your documents, offering a single source for all your data, reports, and financial information. You can track our progress and your profits in real-time, ensuring a transparent and efficient bookkeeping process.

The process of submitting and processing invoices, bank statements, and even agreements (such as your lease) is becoming simpler every day.

House of Companies simplifies the procedure of submitting your data using a single source for all documents, data, and reports. You can track our progress and your profits in real-time!

"I expected it to take a few months to generate turnover in Cyprus. Thanks to House of Companies, I didn't have to worry about hiring an accountant during that time."

Global Talent Recruiter

Global Talent Recruiter"My accountant in India drafts my VAT reports and submits the returns using the Entity Management system! It's been seamless."

Spice & Herbs Export

Spice & Herbs Export"The knowledge and support from House of Companies helped me feel more confident about managing my own tax filing, and it worked perfectly!"

IT firm

IT firmCyprus offers one of the most competitive corporate tax rates in the EU, at 12.5%. This makes it an attractive destination for businesses looking to minimize their tax liabilities while benefiting from the country’s robust legal framework.

Dividends paid by a Cypriot company to its shareholders are exempt from tax in Cyprus, provided the shareholder is a non-resident. This feature makes Cyprus an appealing jurisdiction for holding companies, allowing businesses to efficiently manage international investments.

Cyprus offers generous R&D tax incentives, including deductions for qualifying research and development expenses. Companies engaged in innovation and technological development can benefit from these deductions to reduce their taxable income.

Cyprus adheres to OECD transfer pricing guidelines, meaning companies must ensure that intercompany transactions are conducted at arm's length. Compliance with these rules is critical for multinational companies operating in Cyprus, especially when conducting cross-border transactions.

Despite the evolving nature of global tax and accounting regulations, your situation may require the help of a local tax professional, especially in Cyprus where certain regulations might require local accountants. Cyprus has specific tax regulations enforced by local government agencies such as the Cyprus Tax Department.

At House of Companies, we are here to assist you in preparing and filing your tax returns. Whether you need us to process your existing ledgers or create new ones from scratch, we offer comprehensive support to ensure your business stays compliant.

Learn More →

Learn More →

Learn More →

Feel welcome, and try out our solutions and community,

to bring your business a step closer

to international expansion.

Got questions?

Lets talk about your options

Stay updated with the latest news and exclusive offers. Subscribe to our newsletter for regular insights delivered to your inbox!