House of Companies offers a comprehensive Entity Management Service designed to support both EU and non-EU countries in registering their businesses in Cyprus. Our service simplifies the entire process, ensuring a smooth and efficient setup. Here’s how we support you:

- Entity Management Portal: Our innovative portal allows you to buy a readymade company, streamlining the registration process.

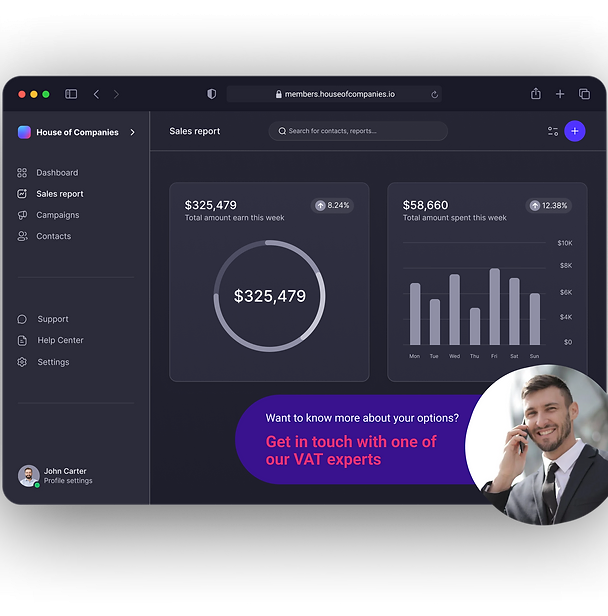

- Compliance and Documentation: We handle all necessary documentation and ensure full compliance with local regulations, including obtaining a tax identification number and VAT registration if required.

- Expert Guidance: Our team of experts provides personal guidance throughout the registration process, ensuring you understand each step and make informed decisions.

- Strategic Advantages: By setting up your business in Cyprus, you benefit from its favorable tax regime, strategic location, and robust legal framework.

With House of Companies, you can efficiently establish your business in Cyprus, leveraging the numerous advantages the country offers while avoiding the complexities of traditional registration processes.

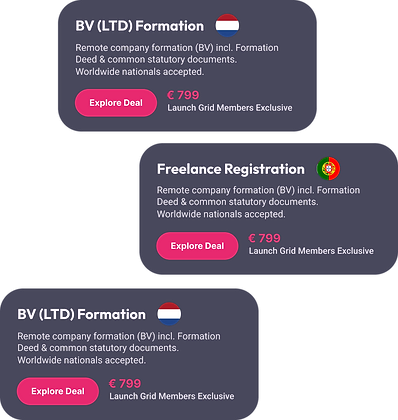

House of Companies offers an Entity Management Service that serves both EU and non-EU countries, including Cyprus. Here are some highlighted EU countries where our services can be particularly beneficial:

- Germany: Known for its strong economy and business-friendly environment, Germany offers numerous opportunities for entrepreneurs.

- France: With its strategic location and robust infrastructure, France is an attractive destination for business expansion.

- Netherlands: The Netherlands is renowned for its favorable tax policies and advanced logistics network, making it ideal for international trade.

- Ireland: Ireland's low corporate tax rate and English-speaking workforce make it a popular choice for business setup.

- Spain: Spain's growing economy and access to Latin American markets provide significant advantages for businesses.

Incorporating a business in Cyprus involves several key steps to establish its legal existence and enable it to conduct business activities. Here’s an overview of the process:

-

Selecting a Company Name: The first step is to choose a unique company name and get it approved by the Department of Registrar of Companies and Official Receiver.

-

Preparing Documentation: Essential documents include the Memorandum and Articles of Association, which outline the company’s structure and operations. These documents must be drafted and signed by the company’s directors and shareholders.

-

Submission to Authorities: The prepared documents, along with the application forms, are submitted to the Department of Registrar of Companies and Official Receiver for approval and registration.

-

Obtaining a Tax Identification Number (TIN): Once the company is registered, it must apply for a Tax Identification Number from the Tax Department. This number is essential for all tax-related matters and compliance.

-

VAT Registration: If the company’s annual turnover exceeds the VAT threshold, it must register for Value Added Tax (VAT). This involves submitting an application to the VAT Service.

-

Compliance and Reporting: After incorporation, the company must comply with ongoing reporting and regulatory requirements, including annual returns and financial statements.

House of Companies' Entity Management Service

House of Companies provides an Entity Management Service that simplifies the incorporation process in Cyprus. This service is available for both EU and non-EU countries and includes:

- Entity Management Portal: An innovative platform where you can purchase a readymade company, ensuring a quick and efficient setup.

- Compliance Assistance: Guidance on preparing and submitting all necessary documentation, as well as obtaining a Tax Identification Number and VAT registration.

- Expert Support: Personalized support from our team of experts to navigate the incorporation process and ensure full compliance with local regulations.

Navigating the bureaucratic landscape can be a daunting task for any entrepreneur, especially when setting up a business in a new country. Efficiently handling bureaucracy involves understanding the local regulations, preparing the necessary documentation, and ensuring compliance with all legal requirements. This process can be streamlined by leveraging technology and expert guidance, which can significantly reduce the time and effort involved.

One of the first steps in managing bureaucracy is to familiarize yourself with the specific requirements of the country where you plan to establish your business. This includes understanding the registration process, tax obligations, and any industry-specific regulations. Utilizing online resources and consulting with local experts can provide valuable insights and help you avoid common pitfalls. Additionally, many countries offer online portals that simplify the registration process, allowing you to complete necessary steps without the need for in-person visits.

Another crucial aspect of handling bureaucracy efficiently is to maintain organized and accurate records. This includes keeping track of all correspondence, forms, and approvals related to your business setup. Digital tools and software can be incredibly helpful in this regard, providing a centralized platform for document management and ensuring that all necessary information is easily accessible. Regularly updating your records and staying informed about any changes in regulations can also help you stay compliant and avoid potential issues.

Finally, seeking professional assistance can make a significant difference in navigating bureaucratic processes. Services like House of Companies' Entity Management Service offer expert guidance and support, helping you manage the complexities of business registration and compliance. By leveraging such services, you can focus on growing your business while ensuring that all bureaucratic requirements are handled efficiently and effectively.

House of Companies offers an Entity Management Service in Cyprus that ensures affordable compliance and legal advice for businesses. Our service streamlines the process of setting up and maintaining a company, providing expert guidance on regulatory requirements and legal obligations. By leveraging our innovative Entity Management Portal, entrepreneurs can efficiently manage their compliance needs, access professional legal advice, and ensure their business operates within the legal framework, all at a cost-effective rate.