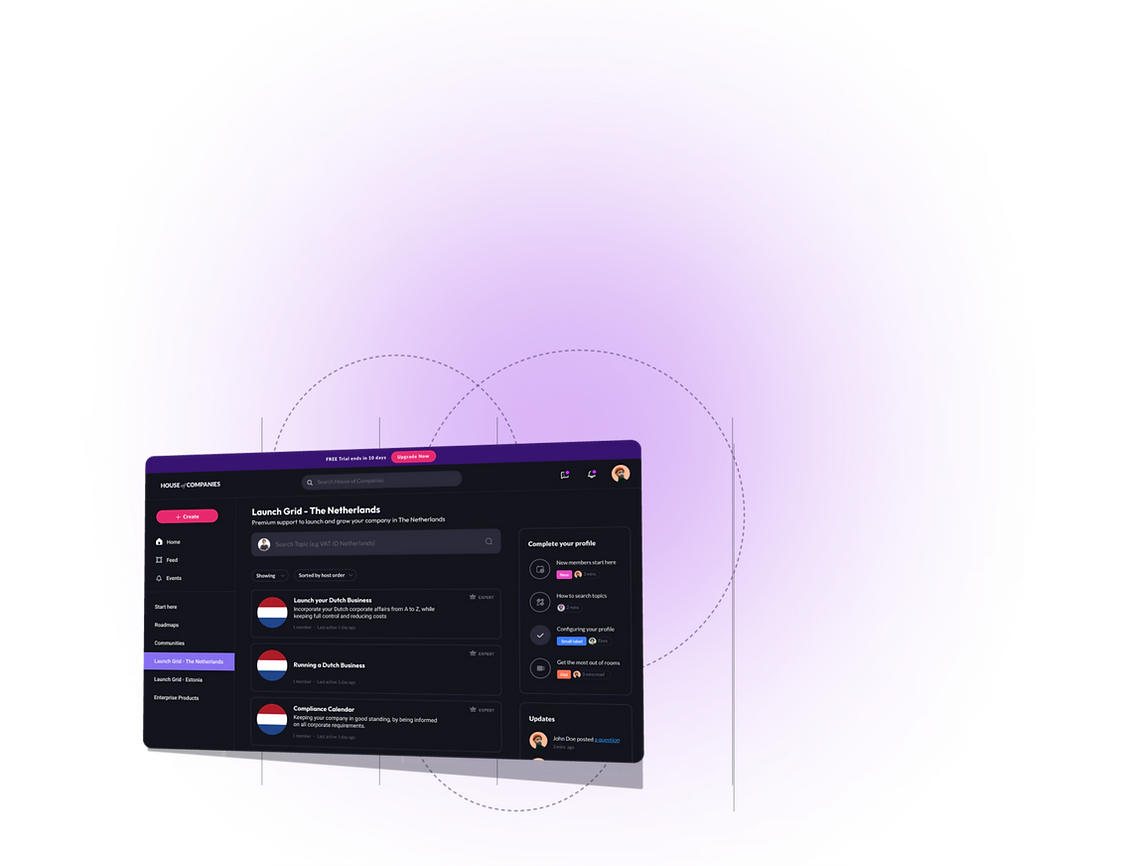

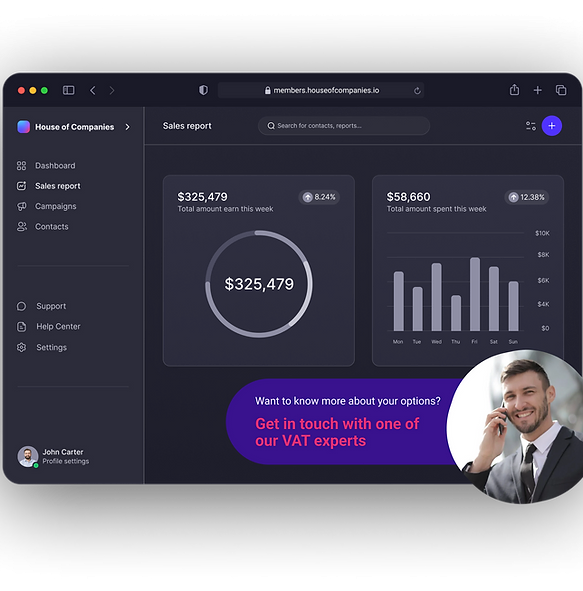

House of Companies provides comprehensive solutions for e-commerce entrepreneurs to streamline international sales through Cyprus. By optimizing and automating the VAT return process according to Cyprus Tax Department regulations, we enable seamless expansion into new markets without the burden of complex tax compliance.

Our cutting-edge Document Scanning and Validation service ensures accuracy and efficiency in managing essential documentation required by Cypriot authorities. Furthermore, our platform facilitates real-time VAT reporting tailored to the specific requirements of Cyprus and other EU countries, empowering businesses to navigate international growth with confidence and ease.

CFO of Tech Solutions Ltd

CFO of Tech Solutions Ltd Managing Director of EuroTrade Group

Managing Director of EuroTrade Group Owner of Global Fashion Hub

Owner of Global Fashion Hub