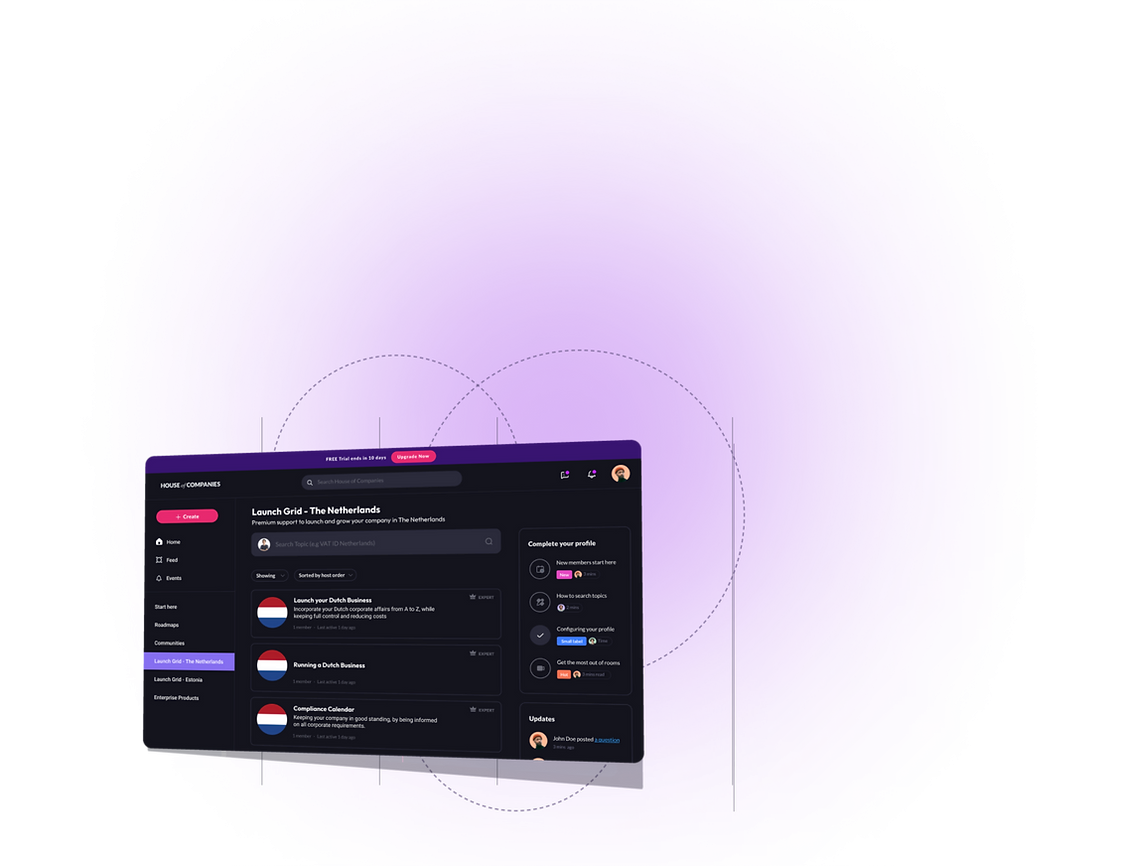

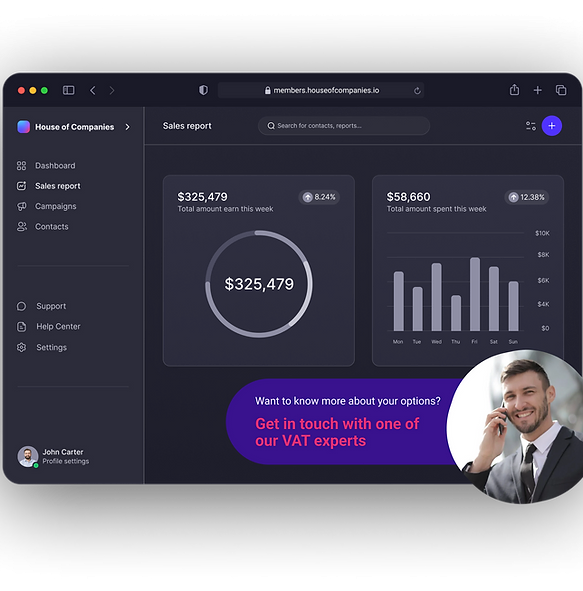

One Control Panel to manage the incorporation of your company and navigate other corporate challenges during your global expansion. Experience the most cost-effective and efficient way to incorporate your company overseas, complete with the tools and community support to ensure your market entry is successful.

Emily Jacobs

Emily Jacobs  Carlos Hernandez

Carlos Hernandez Haruto Nakamur

Haruto Nakamur